BTC Price Prediction: Navigating the Current Market Crosscurrents

#BTC

- Technical Outlook: Oversold conditions with bullish MACD signal potential rebound

- Market Sentiment: Divided between institutional adoption and short-term volatility

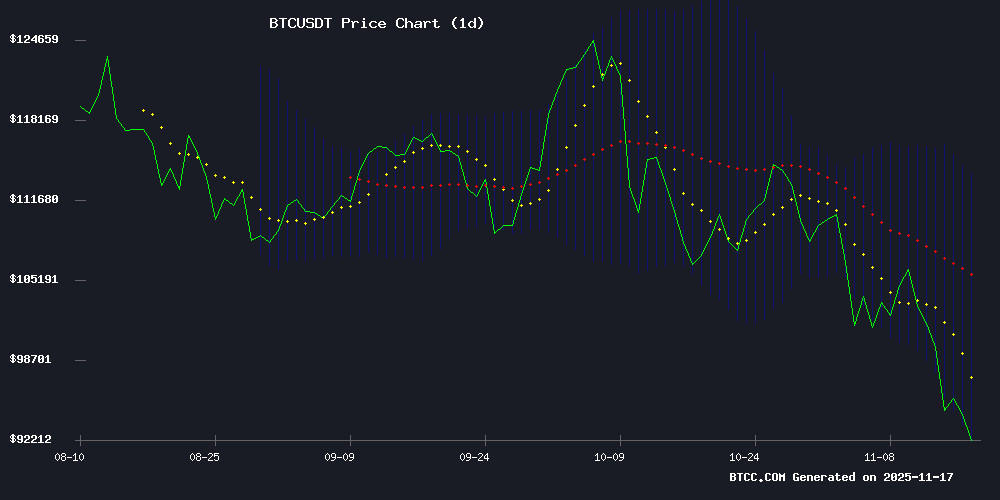

- Key Levels: 92,867 USDT (support) vs 103,140 USDT (20MA resistance)

BTC Price Prediction

BTC Technical Analysis: Key Indicators and Future Trends

According to BTCC financial analyst Ava, Bitcoin (BTC) is currently trading at 95,668.30 USDT, below its 20-day moving average (MA) of 103,140.69. The MACD indicator shows a bullish crossover with the MACD line at 6,482.08 above the signal line at 4,906.58, suggesting potential upward momentum. However, the price is near the lower Bollinger Band at 92,867.10, indicating oversold conditions. Ava notes that a rebound towards the middle band at 103,140.69 is possible if buying pressure increases.

Market Sentiment: Mixed Signals Amid Volatility

BTCC financial analyst Ava highlights conflicting market signals. Negative headlines like 'Bitcoin Slumps to Six-Month Low' and institutional outflows contrast with bullish developments such as Harvard's tripled bitcoin ETF holdings and a Trump-backed venture securing $220M. Ava cautions that while macroeconomic uncertainty persists, long-term institutional adoption continues to grow.

Factors Influencing BTC’s Price

Bitcoin and Crypto Market Shed $1 Trillion Amid Leverage and Institutional Outflows

The global cryptocurrency market has plummeted by over $1 trillion in just six weeks, marking one of its steepest declines since October. Analysts attribute the downturn not to weak fundamentals but to excessive leverage and significant institutional outflows.

Market participants are grappling with the rapid deleveraging, which has exacerbated volatility across major digital assets. The sell-off reflects a broader recalibration of risk appetite among institutional investors, rather than a loss of confidence in blockchain technology's long-term prospects.

Harvard University Triples Bitcoin ETF Holdings to $443 Million

Harvard Management Company has aggressively expanded its exposure to Bitcoin through BlackRock's iShares Bitcoin Trust (IBIT), increasing holdings by 257% in Q3 2025. The Ivy League endowment now holds 6.8 million shares worth $442.8 million, making it Harvard's largest declared U.S. investment position.

The move signals growing institutional acceptance of cryptocurrency as a legitimate asset class. IBIT now represents 0.6% of Harvard's $57 billion endowment, surpassing its stakes in tech giants like Microsoft and Amazon. Such allocations from traditional endowment funds remain rare but increasingly noteworthy.

Other educational institutions followed suit, with Emory University growing its Bitcoin ETF position by 91%. Abu Dhabi's Al Warda Investments mirrored Harvard's bullish stance with a 230% increase in IBIT shares. These developments underscore Bitcoin's evolving role in institutional portfolios despite its volatile nature.

Bitcoin's Technical Breakdown Sparks Market Anxiety

Bitcoin's recent 10% weekly decline below the 50-week moving average has rattled investor confidence. The breach of this key support level—previously a reliable 'buy the dip' threshold since 2023—now signals potential prolonged downside risk.

Technical analysts note the $102,868 level has flipped from support to resistance. Failure to reclaim this price zone may trigger cascading sell pressure, marking a shift from bullish momentum to cautious market sentiment.

Bitcoin's Subdued Reaction to the 2025 U.S. Shutdown Compared to 2019

The 2025 U.S. government shutdown marked a departure from historical precedents, not just in duration but in market reaction. Bitcoin, trading at $94,000, became a focal point for investors gauging macroeconomic stability. Unlike the 2019 shutdown, which triggered volatility, this episode saw subdued price action—a testament to Bitcoin's maturation as a macro asset.

Political dynamics under President Trump played a key role. His administration's approach to fiscal policy and public communication created an environment where markets, including crypto, reacted more predictably. The shutdown unfolded against a backdrop of institutional adoption, with traders viewing Bitcoin as a hedge rather than a speculative play.

Liquidity conditions differed sharply from 2019. Back then, Bitcoin's $3,000 price reflected a nascent market prone to overreaction. By 2025, deeper order books and ETF inflows provided stability, muting the explosive moves seen in prior crises.

World’s Highest IQ Holder Predicts Bitcoin to Hit $220K In Next 45 Days

Kim Young-hoon, a South Korean prodigy with a verified IQ of 276, has made a bold prediction that Bitcoin will surge to $220,000 within the next 45 days. This forecast comes as Bitcoin struggles to regain momentum, currently trading near $95,700 amid market volatility.

The claim has ignited debate among investors, particularly given its divergence from mainstream analyst projections. A move to $220,000 would represent a 126% gain from current levels—a scenario many find improbable given prevailing macroeconomic uncertainty and erratic ETF flows.

Kim stated his intention to dedicate 100% of Bitcoin profits to building churches worldwide, quoting Luke 1:37: "For with God nothing shall be impossible." The proclamation adds a philosophical dimension to what would otherwise be a purely financial prediction.

Japan's $110 Billion Stimulus Package: Implications for Crypto Markets

Japan has unveiled a stimulus package exceeding ¥17 trillion ($110 billion) to address economic contraction and rising costs. The economy shrank 1.8% in Q3 2025, marking the end of a six-quarter growth streak. The package includes cash aid, tax relief, and incentives for AI and high-tech sectors.

Labor shortages continue to weigh on Japan's economy, costing approximately ¥16 trillion annually—2.6% of GDP. The weaker yen resulting from increased liquidity could drive capital toward risk assets, including Bitcoin and other cryptocurrencies.

Finance Minister Satsuki Katayama confirmed the stimulus after meeting with Prime Minister Sanae Takaichi. The cabinet is set to approve the full plan on November 21.

Daily Market Update: Crypto Volatility Amid Key Economic Events

US stock futures climbed Sunday evening, with Nasdaq 100 futures rising 0.6% as investors braced for a pivotal week. Nvidia's earnings report on Wednesday and September's delayed jobs data on Thursday loom large, offering critical signals for market direction.

Bitcoin's precipitous 30% plunge from its $126,000 peak to sub-$94,000 levels erased its year-to-date gains, sparking over $900 million in crypto liquidations across nearly 250,000 traders. The selloff reflects mounting volatility as institutional players paradoxically increase exposure—73% cite higher return potential as their primary motive.

Regulatory developments advance quietly beneath market turbulence. The SEC's 'Project Crypto' inches toward a 2026 framework proposal, potentially reshaping the landscape for BTC, ETH, and other digital assets. Meanwhile, exchanges like Binance and Coinbase continue absorbing retail flows despite the sector's whipsaw action.

Bitcoin Falls Below Its 2025 Starting Price – Is the Bull Cycle in Trouble?

Bitcoin briefly dipped below its 2025 opening price, erasing year-to-date gains during a volatile weekend that caught traders off guard. The cryptocurrency slid to $93,100, marking a 25% drop from its October all-time high, before rebounding to $94,500. This pullback underscores a growing divergence between strong structural developments in crypto and current market sentiment.

Despite regulatory progress under the Trump administration and consistent inflows into spot Bitcoin ETFs, macro headwinds have dominated. Tariff battles and a record 43-day U.S. government shutdown fueled risk-off sentiment, triggering multiple double-digit corrections this year. Selling pressure from long-term holders has further complicated the market dynamics.

Bitcoin Slumps to Six-Month Low Ahead of Pivotal FOMC Meeting

Bitcoin tumbled to $93,000, its weakest level in half a year, as fading hopes for Federal Reserve rate cuts rattled crypto markets. The benchmark cryptocurrency shed 7% last week, extending its losing streak to three consecutive weeks. Traders now see just a 40% chance of a December rate cut—down from near-certainty earlier this month—after Fed officials highlighted persistent inflation and labor market strength.

The selloff drained momentum from this year's crypto rally, triggering outflows from Bitcoin spot ETFs and dampening overall demand. Market uncertainty intensified after delayed U.S. economic reports, including Thursday's crucial payrolls data, left investors navigating without key indicators.

This week's packed economic calendar—featuring the FOMC meeting and major data releases—could determine crypto's next directional move. As CryptoChatter noted on X, the confluence of events creates potential inflection points for risk assets. The reopening of U.S. government operations marks the first in a series of high-impact developments.

Bitcoin Plunges to $93K Amid Market-Wide Liquidation Crisis

Bitcoin collapsed to $93,000 in early Asian trading, erasing all gains made in 2025 and triggering the largest liquidation event since the FTX collapse. Over 150,000 traders saw $510 million in positions vaporized as long leverage unwound violently.

The breakdown below $94,000 shattered key technical support, with the Crypto Fear & Greed Index plunging to 'extreme fear' levels not seen since 2024. BitMEX's Tom Lee characterized the selloff as a market-maker liquidity crunch rather than fundamental weakness, noting Bitcoin had already corrected 24% from its $125,000 October peak.

Market structure appears fragile as automated liquidations beget further selling. Analysts now watch whether institutional buyers will step in at these levels, or if the cascade continues toward the $85,000 Fibonacci support zone.

Trump Family-Backed Bitcoin Venture Secures $220M Pre-IPO Funding

American Bitcoin, a mining and accumulation venture co-led by Eric Trump and Donald Trump Jr., has closed a $220 million pre-IPO round with notable participation from Solari Capital. AJ Scaramucci's firm committed over $100 million despite past political tensions, underscoring Bitcoin's apolitical appeal. "Bitcoin transcends politics," Scaramucci remarked, framing the investment as purely financial.

The fundraising attracted high-profile backers including Tony Robbins and Charles Hoskinson, signaling institutional confidence amid crypto market volatility. The capital injection highlights growing convergence between traditional finance and digital assets, with mining operations emerging as a strategic entry point for legacy investors.

Is BTC a good investment?

Based on the current technicals and market sentiment, BTCC analyst Ava suggests BTC presents both opportunities and risks:

| Metric | Value | Implication |

|---|---|---|

| Current Price | 95,668 USDT | 13% below 20MA |

| MACD | Bullish crossover | Short-term upside potential |

| Bollinger Bands | Near lower band | Oversold conditions |

While technical indicators suggest a possible rebound, investors should monitor institutional flows and macroeconomic developments closely.